When suppliers face chargebacks and deductions, having the right documentation can make all the difference in successfully resolving these disputes. Chargebacks and deductions can result in significant financial losses if not properly addressed.

In this blog post, we’ll explore the key documents that suppliers require when disputing and the best practices for documentation management to maintain them.

Page Contents

Key Documents Suppliers Require

Proof Of Delivery (POD)

A Proof of Delivery (POD) is a crucial document that serves as evidence that the goods were delivered to the intended recipient. It typically includes the recipient’s signature, date, time, and any special instructions or notes regarding the delivery. PODs are essential when disputing chargebacks or deductions related to claims of non-delivery or incomplete shipments.

Bill Of Lading (BOL)

A Bill of Lading (BOL) provides detailed information about the goods being shipped, including the shipper, consignee, carrier, weight, and quantity. BOLs are crucial when disputing chargebacks or deductions related to discrepancies in shipment details or damages during transit.

Purchase Order (PO) (EDI 850)

A Purchase Order (PO) is a commercial document issued by a buyer to a supplier, indicating the products, quantities, and agreed-upon prices for a particular order. In the context of chargebacks and deductions, POs serve as evidence of the agreed-upon terms between the supplier and the buyer, making them invaluable when disputing claims related to pricing, quantities, or unauthorized substitutions.

Invoice (EDI 810)

An Invoice (EDI 810) is a document issued by the supplier to the buyer, detailing the products or services provided, quantities, prices, and payment terms. Invoices are essential when disputing chargebacks or deductions related to pricing discrepancies, duplicate payments, or unauthorized deductions.

ASNs (Advance Shipment Notice) (EDI 856)

Advance Shipment Notices (ASNs) (EDI 856) are electronic notifications sent by the supplier to the buyer, providing detailed information about an upcoming shipment. ASNs include information such as the shipment contents, quantities, expected delivery date, and more.

These documents can be valuable when disputing chargebacks or deductions related to discrepancies in the shipment details or delivery times.

Best Practices for Documentation Management

Standard Operating Procedures (SOPs)

The standard operating procedure ensures everyone handles deductions the same way. It provides clear, step-by-step instructions that must be followed whenever a deduction comes up. This consistency makes the process straightforward and efficient. Instead of each person approaching it differently, they all use the same guidelines. This unified approach prevents confusion and mistakes.

- Clear naming conventions ─ Implement clear and consistent naming conventions for documents to facilitate easy retrieval. Include relevant information such as date, deduction type, and other pertinent details.

- Centralized storage for easy retrieval ─ Maintain a centralized repository for all documentation related to chargebacks and deductions. This could be a document management system or a dedicated folder structure on a shared drive. Ensure that documents are organized logically and securely, with appropriate access controls in place.

- Automating documentation workflows where possible ─ Automating documentation workflows can be a game-changer when it comes to managing chargeback and deduction processes. By leveraging automation tools and software, businesses can streamline their documentation workflows, which in turn can lead to improved efficiency, accuracy, and compliance.

The benefits of automating documentation workflows are numerous. Firstly, it can help reduce the risk of human error. Manual data entry is prone to errors, which can lead to costly mistakes in chargeback and deduction management. Automation tools, on the other hand, can help eliminate these errors by automatically populating data fields and cross-referencing information.

Secondly, automating documentation workflows can help businesses save time. With manual processes, employees often spend a significant amount of time on tasks such as data entry and document filing. By automating these tasks, employees can focus on more value-added activities, such as analyzing data and resolving disputes.

Lastly, automation can help improve compliance. Many businesses have specific requirements around how they manage chargebacks and deductions. Automation tools can help ensure that all required fields are completed, and that the right documentation is attached to each claim.

How iNymbus Deduction Management Software Can Help

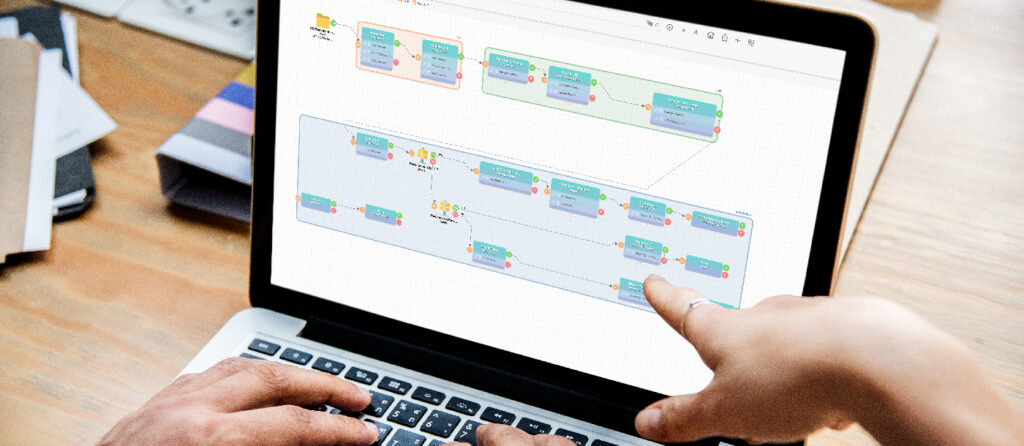

We utilize Robotic Process Automation (RPA) to streamline claims processing workflows. We also automate claim document retrieval from portals, EDI, and emails. It efficiently organizes documentation per audit/retailer specifications.

It enables uploading denied claim packets to vendor portals via automated emails, faxes, or mail. Not just that our software streamlines dispute resolution by uploading organized docs to retailers with auto-filled descriptions.

See how we helped a giant supplier with $2 Billion in annual revenue help tackle deductions from over 25 retailers. Their main concern was Walmart Deduction Management and within a few weeks, we were able to automate the process from end to end. From disputing target shortages to disputing email deductions, our AR deduction management software can do it all.

Conclusion

In the supplier industry, proper documentation is an essential aspect of conducting business. It not only helps in maintaining a record of transactions but also plays a crucial role in winning disputes against chargebacks and deductions.

Key documents such as Proof of Delivery (POD), Bill of Lading (BOL), Purchase Order (PO), Invoice, and Advanced Shipping Notice (ASN) provide critical evidence to support the supplier’s case.

To ensure that they have all the necessary documentation, suppliers need to adopt best practices such as Standard Operating Procedures (SOPs), clear naming conventions, centralized storage, and automation. SOPs can help suppliers define and streamline their documentation management process, ensuring that everyone involved in the process follows the same protocol.

Clear naming conventions can help avoid confusion and make it easier to locate documents when needed. Centralized storage can help ensure that all documents are stored in a single location, making it easier to retrieve them quickly.

Automation is another key aspect of streamlining documentation management.This automation helps suppliers save time and reduce the risk of human error, ensuring that disputes are resolved quickly and accurately.

In conclusion, having proper documentation is crucial for suppliers to win disputes against chargebacks and deductions. By adopting best practices like SOPs, clear naming conventions, centralized storage, and automation, suppliers can streamline their documentation management process and ensure that they have all the necessary evidence to support their case.