Were you aware that solar installation costs have shrunk by over 60% within the past decade? Back then, people would pay over $40,000 for a solar energy system. Today, they can get even better equipment for less than half that price.

Yet, only about 4% of U.S. homes have solar panels installed. Still, experts project that rate to grow faster with the help of the Inflation Reduction Act. This Act, after all, has paved the way for more U.S. consumers to enjoy solar tax credits.

Those incentives, in turn, make installing solar energy systems even more affordable. That’s enough reason to take advantage of them, as they can help you go solar ASAP.

Below, we’ll tell you how those tax breaks work and their eligibility requirements, so read on.

Page Contents

How Solar Tax Credits Save You Money

To start saving with solar, you first need access to solar panels, which can cost thousands of dollars. Fortunately, solar tax credits can help reduce their cost by lowering your tax bill. In doing so, you can save money on the upfront expenses of installing solar panels.

Solar tax credits are dollar-for-dollar reductions on your owed taxes. They differ from deductions, which reduce your taxable income.

Suppose you qualify for a $3,500 tax credit for your residential solar panel system. Claim that, and you can reduce the taxes you owe the government. So if your original tax bill is $5,000, you only have to pay $1,500, thanks to your $3,500 tax credit.

Types of Solar Tax Credits Available

One is the federal solar tax credit, also known as the residential clean energy credit. You may be eligible for this, provided you pay federal income taxes.

Some states also offer state-specific solar tax credits. They work much like the federal credit but apply to state income taxes.

The Federal Solar Tax Credit

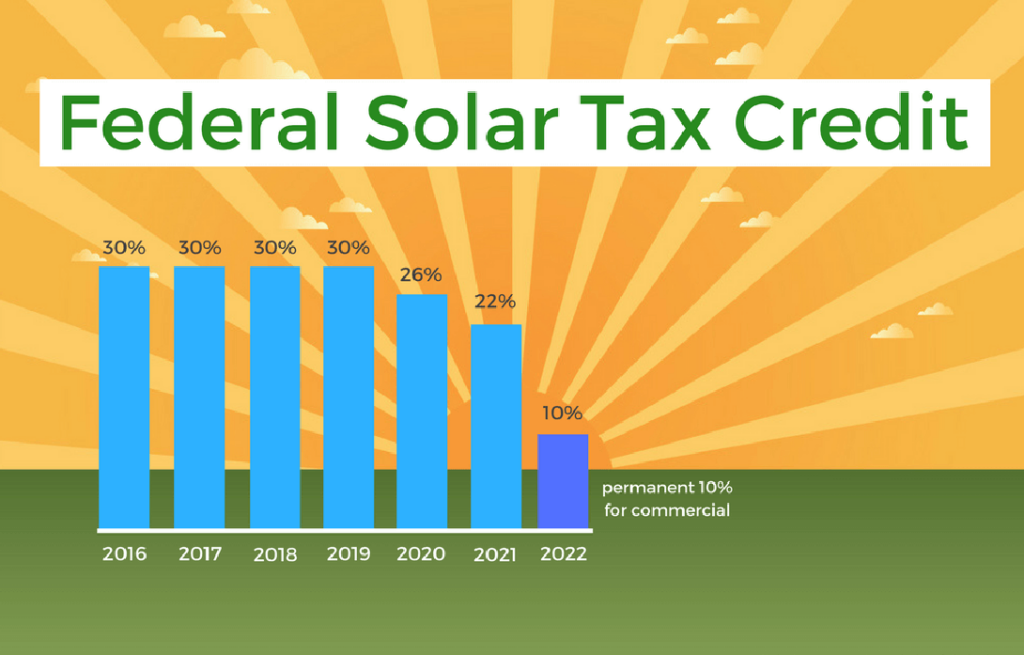

So long as you qualify, you can claim a tax credit of up to 30% of your eligible solar system expenses. That 30% applies to systems installed through 2033.

Let’s say your total eligible expenses amount to $15,000. Therefore, you can claim a credit of up to $4,500 on your federal income taxes.

Even better, the residential clean energy credit doesn’t have caps or limits. That means you can claim a credit on eligible expenses, regardless of how much or how little you spent. You can even roll over any unused portion of your credit to future tax years.

Note, though, that the tax credit drops to 26% come 2033. It then further decreases to 22% by 2034. After that, the solar incentive program expires unless Congress extends it again.

Eligibility Requirements

To qualify for the federal solar tax credit, you must be a federal income taxpayer. You must also install the solar energy system on your primary or secondary residence. It must be operational, meaning it already generates power, to be eligible for the credit.

Only owned solar energy systems qualify for the federal solar tax credit. That means you must purchase one outright or do so through financing, such as a solar loan. If you lease the equipment, the lessor (the party that owns it) gets the credit, not you.

Every component of the solar energy system must also be new. So even though buying used can lead to solar panel savings, it won’t qualify you for the federal tax credit.

Eligible Expenses

The total federal tax credit you can claim depends on the sum of your eligible expenses. These include solar panels, wiring materials, inverters, mounting equipment, and controllers. Energy storage devices with a capacity of at least 3 kilowatt-hours qualify, too.

Other eligible expenses are the costs related to system installation and inspection. You can also claim a credit for sales tax if you’re in a state without a solar sales tax exemption.

State-Specific Tax Credits and Requirements

Some states offer state-specific solar tax credits to their residents. These include Arizona, Hawaii, New Mexico, and New York, to name a few.

If you live in Arizona, you can get up to a 25% solar panel tax credit. However, the maximum you can claim on your income tax is $1,000. Your system must also be in your residence within the state.

In Hawaii, the solar tax credit is 35% or a maximum of $5,000. You may qualify for this as long as your system is in a residential property located in the state.

New Mexico’s solar tax credit is only 10%, but the maximum is higher than Hawaii’s, at $6,000. The state also offers a separate incentive called the Sustainable Building Tax Credit. If you qualify for this, you can get an additional credit of up to $6.50 per square foot.

Like Arizona, New York’s solar tax credit is also at 25%. However, the state allows you to claim up to a maximum credit of $5,000.

Effects of Other Solar Incentives on Tax Credits

State solar tax credits usually don’t reduce those from the federal government. However, you may have to report a higher taxable income on your federal taxes if you get a state tax credit. That could happen if you have fewer state income tax deductions.

State-provided solar panel rebates generally don’t reduce your federal tax credit, either. What may affect it is a rebate given to you by your utility company.

Suppose your utility provider gives you a one-time rebate of $1,500 for installing a system that costs $15,000. To calculate your federal tax credit, subtract the $1,500 from the $15,000 installation cost. Then, multiply it by 0.30 (30% tax credit).

In the scenario above, the formula would be ($15,000 – $1,500) X 0.30. So the answer, which is $4,050, is the total tax credit you can claim on your federal income tax.

Enjoy These Tax Breaks When You Go Solar

Federal and state solar tax credits can reduce your solar energy system costs. Even if you only qualify for one, it can be enough to save you thousands of dollars.

Also, don’t forget about property and sales tax exemptions. Thirty-six states offer the former, while 25 provide the latter. Take advantage of all these incentives, and you can make going solar more affordable.

If you liked this article, you’d love our other educational reads. So, browse more of our news and blog posts now!